This periodic sponsored Q&A column is written by Adam Gallegos of Arlington-based real estate firm Arbour Realty. Please submit follow-up questions in the comments section or via email.

Question: A certain politician has been using $250,000 in income as the benchmark for rich families in America. In an expensive area like Arlington, I’m wondering how much home an income like this can afford you?

That’s an interesting question. I don’t want to touch the political aspect of it with a 10 foot pole, but I’ll do my best to describe what a typical family could purchase with that income.

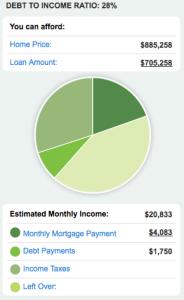

It is a good idea to start with a debt-to-income ratio. In an area like Arlington where the cost of living is nearly 50% higher than the national average, I think we should use a conservative debt-to-income ratio of 28%. Meaning that your total debt will not exceed 28% of your gross income.

(In this case, “debt” refers to obligations including mortgage, car loans, child support and alimony, credit card bills, student loans and association fees.)

In order to calculate how much house they can afford, we need to make some assumptions:

- They have $1,750 a month in car loans, credit card bills and student loans.

- They want a house and many houses in Arlington are not part of a home owners association (HOA). It is safe to assume they will not have any HOA fees.

- They have saved up enough money for a 20% down-payment so we don’t need to worry about private mortgage insurance (PMI).

- Their interest rate is 4% on a 30 year fixed rate mortgage.

According to the online calculator I used, they will qualify for a mortgage of $705,258. If they are putting 20% down, they should be able to purchase a home up to $846,310.

According to the online calculator I used, they will qualify for a mortgage of $705,258. If they are putting 20% down, they should be able to purchase a home up to $846,310.

At the time I am writing this, there are 15 houses available in Arlington with at least 3 bedrooms and 2 baths, within the $750,000 to $850,000 price range.

Again, this is a conservative example for a fictitious loan program. There are financing alternatives that offer different interest rates, terms and down payment options that could allow such a family to purchase a more expensive home. If you have questions about what you could qualify for, it’s best to discuss your specific situation and preferences with someone who can address your individual situation.

The views and opinions expressed in the column are those of the author and do not necessarily reflect the views of ARLnow.com.